Carbon Offsetting – Part 2

This Blog is a follow up to our Blog Carbon – Offsetting Part 1.

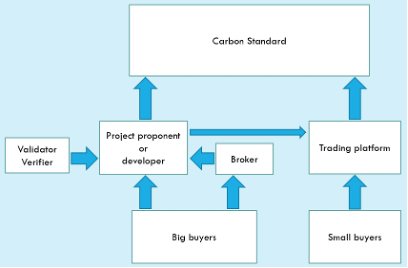

The diagram below is an overview of the structure of the carbon offset markets. The players in these markets are indicated by the labelled boxes. The same players exist in both the Compliance Carbon Markets (CCM) and the Voluntary Carbon Markets (VCM).

Carbon Standard

Carbon offset markets are comprised of carbon offset projects. These projects are either nature-based or avoidance types and include projects such as growing trees, paying landowners not to cut down forests or financing the supply of low emission cookstoves.

The Carbon Standard (aka carbon offset program) is the authority that regulates its own stream of carbon projects. Examples of these Standards are the Clean Development Mechanism, used in the CCM, and VERRA in the VCM. In Australia, the Clean Energy Regulator (who represents the Australian Federal Government) is the Carbon Standard that oversees the Emissions Reduction Fund (ERF). The ERF is part of the CCM.

A Carbon Standard is responsible for ensuring offset projects maintain their integrity. The Carbon Standard does this by:

• Either developing/co-developing the methodology underpinning the offset project or reviewing and approving new methodologies that meet the requirements of crediting baseline, additionality, permanence and leakage.

• Ensuring stringent risk assessment measures for projects (for example, assessing the risk of bushfires for forestation projects, including measures to decrease the risk of a bushfire event).

• Approving new projects including reviewing the validator’s report.

• Overseeing the scheduled third-party verification of ongoing projects to ensure projects are proceeding as planned.

• Maintaining a registry of offsets created and retired.

The Damocles sword hanging over the heads of Carbon Standards is the requirement to maintain the quality of the offsets. This is a significant responsibility, but imperative to achieve legitimate net zero outcomes.

Project Proponent

A project proponent can be a single person, multiple people or an organisation who is legally responsible for running an offset project. This means they hold the legal right to the project and are issued the carbon credits by the relevant Carbon Standard as created from approved project activities.

A project proponent who does not think he or she has the technical expertise or administrative resources to manage your project can engage an agent. Agents act on behalf of project proponents according to the terms of the agency agreement entered into, for example by providing reports on projects, submitting applications for carbon credits and generally dealing with the Carbon Standard.

Whether an agent is appointed, or not, the project proponent is still legally accountable to the Carbon Standard for carrying out the project and meeting all obligations. The proponent retains ultimate control of the project and is issued the carbon credits to their Carbon Standard account.

Project Developer or Aggregator

Project proponents can choose to assign their proponent rights to someone else i.e. called aggregators or developers. This means they have the legal right to run the project and can claim the carbon credits for the project. They are responsible for carrying out the project and meeting all obligations as required by the Carbon Standard.

Project aggregators or developers (aka carbon service providers) are private businesses or organisations, independent of government, that offer a range of services in developing and running carbon abatement projects.

It’s important to note that engaging a carbon service provider occurs via a private or commercial agreement that outlines how roles, responsibilities, obligations, risks and benefits are shared. The Carbon Standard is not responsible for the terms of any private agreements or for their enforcement.

Validators and Verifiers

Once a project is ready for submission to the Carbon Standard, it needs to be validated by a certified organisation to ensure all matters pertaining to its operation and underpinning methodology have been addressed.

Approved verifiers are utilized (normally on a two-year cycle) to review and confirm the carbon offset project is meeting its timelines and conforming to approved procedures.

Brokers and other intermediaries

Currently, the sale of most carbon offsets takes place over-the-counter (OTC). Carbon offset brokers introduce buyer and seller in the marketplace. Brokers do not usually take ownership of the underlying carbon offset credit but help facilitate the transaction in exchange for a commission. Brokers primarily operate in the CCM, as there are more frequent and higher volume trades at higher prices in the CCM, but some brokers are becoming much more active in the VCM lately.

Other intermediaries include carbon offset retailers (aka retail aggregators) that have the authority to buy offsets from project proponents/aggregators and then sell those offsets to a third party (the retail aggregator is responsible for retiring the offsets sold).

Big Buyers

The big buyers are usually large corporations (for example, airlines that offset travellers’ flights) who enter into OTC deals to secure long-term offset supply. Whilst carbon markets are evolving quickly, the bulk of offset deals are still OTC.

With the rising prices in the carbon offset markets, a new entrant in the big buyers category is the hedge fund.

Trading Platforms

One of the original trading platforms was created by the United Nations’ Clean Development Mechanism to allow the public to buy carbon offsets directly (https://offset.climateneutralnow.org/). For offsets sold, a certificate is issued confirming the retirement of those offsets from the registry.

Latterly, the carbon markets have seen the rise of trading platforms like CBL, CTX and Markit that list carbon offsets created under varying Carbon Standards and available for sale to retail aggregators who can then retire the offsets acquired on behalf of third parties.

We will keep you posted of the rise of trading platforms in global carbon markets and their place in the Article 6 regime, including their place in the global emissions trading schemes.

Small Buyers

Householders, companies and organisations often seek to be carbon neutral. Over the last ten years there has been a proliferation of carbon offset programs operated by aggregators or retail aggregators selling to the public. Just go onto the internet and you will find many opportunities to buy offsets that are advertised to offset the carbon emissions of the selected activity.

In Australia, the Carbon Market Institute maintains a registry of carbon projects selling offsets to people and organisations (https://carbonmarketinstitute.org/markets/).

For those who can work out the actual carbon footprint of their selected activity, there is the opportunity to compare the tonnes apportioned to that activity and the total price charged (just in case the retailer made a mistake)!