TCFD recommendations

In our last blog, we referred to the alphabet soup of organisations involved in ESG. An organisation’s name that kept cropping up though, was the Task Force on Climate-Related Disclosure (TCFD). Currently, its recommendations are being adopted by the large ESG frameworks and even within the regime of new government regulations on mandatory ESG disclosure.

From our last blog:

“The UK Government confirmed on 29 October that it will make it mandatory for large companies to disclose information in alignment with the recommendations of the TCFD from April 2022. This makes the UK the first G20 country to enshrine the mandate into law, subject to Parliament approval. More than 1,300 of the largest UK-registered companies and financial institutions will have to disclose climate-related financial information on a mandatory basis – in line with the TCFD.

Meanwhile, in New Zealand, beginning in 2023, new laws will require financial firms to explain how they would manage climate-related risks and opportunities with disclosure requirements based on the TCFD standards and the standards of New Zealand’s independent accounting body the External Reporting Board (XRB).”

TCFD’s formation came in 2015 at the bequest of the Financial Stability Board (FSB), an international body that monitors and makes recommendations about the global financial system. The FSB called on the Task Force to develop climate-related disclosures that “could promote more informed investment, credit [or lending], and insurance underwriting decisions” and, in turn, “would enable stakeholders to understand better the concentrations of carbon-related assets in the financial sector and the financial system’s exposures to climate-related risks.”

The reason for focusing on financial-sector organisations like banks, insurance companies, asset managers and asset owners was and is their undeniable capacity to influence the organisations in which they invest to provide better climate-related financial disclosures.

From TCFD’s website (https://www.fsb-tcfd.org/about/):

“Currently, investors, lenders, and insurers don’t have a clear view of which companies will endure or even flourish as the environment changes, regulations evolve, new technologies emerge, and customer behaviour shifts — and which companies are likely to struggle.

Without reliable climate-related financial information, financial markets cannot price climate-related risks and opportunities correctly and may potentially face a rocky transition to a low-carbon economy, with sudden value shifts and destabilizing costs if industries must rapidly adjust to the new landscape.”

Essentially, TCFD encourages organisations to undertake both historical and forward-looking analyses, dividing climate-related risks into risks related to the transition to a lower-carbon economy and risks related to the physical impacts of climate change. It also encourages organisations to look for climate-related opportunities.

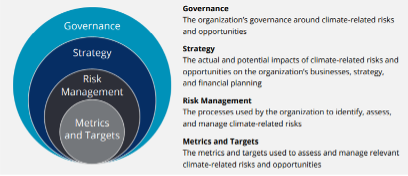

When considering the potential financial impacts of climate change, TCFD structures disclosures around four thematic areas that represent core elements of how organisations operate:

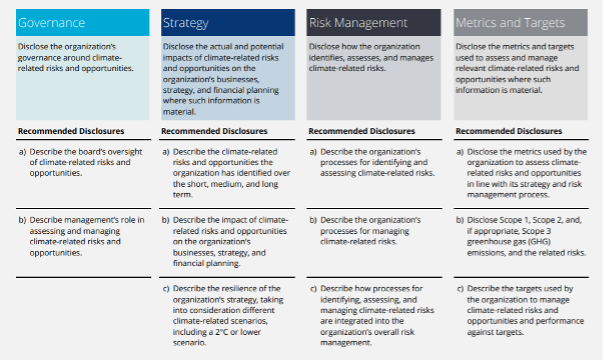

The table below summarizes the current recommended disclosures under each core element.

Source: Final Report – Recommendations of the Task Force on Climate-related Financial Disclosures

More details/specifics of recommended disclosures under each core element can be found at pages 19 to 23 of TCFD’s report. Examples of climate-related risks can be found at page 10 of the same report.

Likewise, examples of potential opportunities for organisation can be found at page 11 of that report.

TCFD has interconnected its recommendations with the two primary accounting standard setting bodies, the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB and their standards addressing risks and uncertainties that affect companies.

Additionally, TCFD has made it clear that their disclosure recommendations are not static and with improved data analytics and more widespread modeling of climate-related issues, disclosures will mature accordingly.

In conclusion, TCFD’s climate-related disclosure requirements mean that organisations seeking approval for investment capital or finance will need to do more than just produce their balance sheet and accounts for the last three years to get across the line. Further, you can be damn sure that insurance companies won’t be shy either when it comes to insurance policy application and/or damage claims requirements.

This whole new extension of corporate management and reporting responsibility not only affects large organisations, it will quickly filter down and affect SME operations too.s