Implementing TCFD recommendations – CarbonView can assist you!

In our last blog, we briefly reviewed the requirements of the Task Force on Climate-Related Disclosure (TCFD), alluding to the fact that its recommendations are being adopted by the large ESG frameworks and even within the regime of new government regulations on mandatory ESG disclosure.

In this blog, we list recommended actions to meet TCFD climate-related financial disclosure criteria. This, with a view to assisting your organisation boost its ESG credentials, minimize climate risk, identify climate-related opportunities and develop sound climate-related financial disclosure.

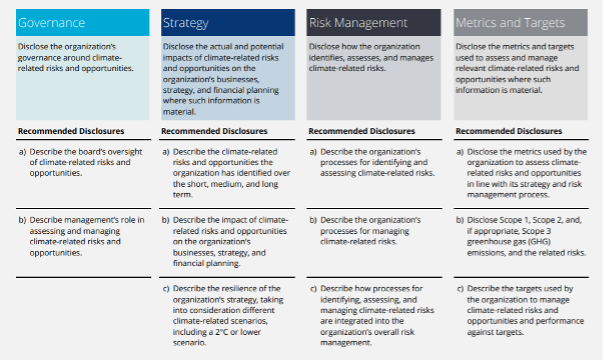

In the TCFD report there are four thematic elements of climate-related disclosure. The illustration below lists these four elements, with recommended topics to be applied under each element:

Source: Final Report – Recommendations of the Task Force on Climate-related Financial Disclosures

More specific actions that should be taken under each topic are included in the same TCFD report and summarized here:

Governance – In describing the board’s oversight of climate-related issues, organizations should consider including a discussion of the following:

• Processes and frequency by which the board and/or board committees (e.g., audit, risk, or other committees) are informed about climate-related issues.

• Whether the board and/or board committees consider climate-related issues when reviewing and guiding strategy, major plans of action, risk management policies, annual budgets, and business plans as well as setting the organization’s performance objectives, monitoring implementation and performance, and overseeing major capital expenditures, acquisitions, and divestitures.

• How the board monitors and oversees progress against goals and targets for addressing climate-related issues.

Governance – In describing management’s role related to the assessment and management of climate-related issues, organizations should consider including the following information:

• Whether the organization has assigned climate-related responsibilities to management-level positions or committees; and, if so, whether such management positions or committees report to the board or a committee of the board and whether those responsibilities include assessing and/or managing climate-related issues.

• A description of the associated organizational structure(s).

• Processes by which management is informed about climate-related issues.

• How management (through specific positions and/or management committees) monitors climate-related issues.

Strategy – Organizations should provide the following information:

• A description of what they consider to be the relevant short-, medium-, and long-term time horizons, taking into consideration the useful life of the organization’s assets or infrastructure and the fact that climate-related issues often manifest themselves over the medium and longer terms.

• A description of the specific climate-related issues for each time horizon (short, medium, and long term) that could have a material financial impact on the organization.

• A description of the process(es) used to determine which risks and opportunities could have a material financial impact on the organization. Organizations should consider providing a description of their risks and opportunities by sector and/or geography, as appropriate. In describing climate-related issues, organizations should refer to Tables 1 and 2 of the report (pp. 10-11).

Strategy – Organizations should discuss how identified climate-related issues have affected their businesses, strategy, and financial planning:

• Organizations should consider including the impact on their businesses and strategy in the following areas:

‒ Products and services

‒ Supply chain and/or value chain

‒ Adaptation and mitigation activities

‒ Investment in research and development

‒ Operations (including types of operations and location of facilities)

• Organizations should describe how climate-related issues serve as an input to their financial planning process, the time period(s) used, and how these risks and opportunities are prioritized. Organizations’ disclosures should reflect a holistic picture of the interdependencies among the factors that affect their ability to create value over time. Organizations should also consider including in their disclosures the impact on financial planning in the following areas:

‒ Operating costs and revenue

‒ Capital expenditures and capital allocation

‒ Acquisitions or divestments

‒ Access to capital

• If climate-related scenarios were used to inform the organization’s strategy and financial planning, such scenarios should be described (a typical scenario being 2ºC or less scenario -refer to Section D of the TCFD report for information on applying scenarios to forward-looking analysis).

Strategy – Organizations should describe how resilient their strategies are to climate-related risks and opportunities, taking into consideration risks of a transition to a lower-carbon economy consistent with a 2°C or lower scenario and, where relevant to the organization’s scenarios, consistent with increased physical climate-related risks including:

• Where they believe their strategies may be affected by climate-related risks and opportunities.

• How their strategies might change to address such potential risks and opportunities.

• The climate-related scenarios and associated time horizon(s) considered.

Risk Management – Organizations should describe their risk management processes for identifying and assessing climate-related risks including:

• A description of how organizations determine the relative significance of climate-related risks in relation to other risks.

• Whether they have considered existing and emerging regulatory requirements related to climate change (e.g., limits on emissions) as well as other relevant factors.

• Organizations should also consider disclosing the following:

‒ Processes for assessing the potential size and scope of identified risks.

‒ Definitions of risk terminology used or references to existing risk classification.

Risk Management – Organizations should describe their processes for managing climate-related risks, including:

• How they make decisions to mitigate, transfer, accept, or control those risks.

• How organizations describe their processes for prioritizing climate-related risks, including how materiality determinations are made within their organizations.

• The processes for managing climate-related risks, including the risks included in Tables 1 and 2 of the TCFD report (pp. 10-11), as appropriate.

• Organizations should describe how their processes for identifying, assessing, and managing climate-related risks are integrated into their overall risk management.

Metrics & targets – Organizations should provide the key metrics used to measure and manage climate-related risks and opportunities, as described in Tables 1 and 2 (pp. 10- 11) including:

• Organizations should consider including metrics on climate-related risks associated with water, energy, land use, and waste management where relevant and applicable.

• Where climate-related issues are material, organizations should consider describing whether and how related performance metrics are incorporated into remuneration policies.

• Where relevant, organizations should provide their internal carbon prices as well as climate-related opportunity metrics such as revenue from products and services designed for a lower-carbon economy.

• Metrics for historical periods to allow for trend analysis.

• Where not apparent, organizations should provide a description of the methodologies used to calculate or estimate climate-related metrics.

Metrics & targets – Organizations should provide:

• Their Scope 1, Scope 2 and relevant Scope 3 GHG emissions and the related risks using the GHG Protocol methodologies to allow for aggregation and comparability across organizations and jurisdictions.

• As appropriate, generally accepted industry-specific GHG efficiency ratios.

• Historical periods of GHG emissions and associated metrics to allow for trend analysis.

• In addition, where not apparent, a description of the methodologies used to calculate or estimate the metrics.

Metrics & targets – Organizations should describe:

• Their key climate-related targets such as those related to GHG emissions, water usage, energy usage, etc., in line with anticipated regulatory requirements or market constraints or other goals.

• Other goals including efficiency or financial goals, financial loss tolerances, avoided GHG emissions through the entire product life cycle, or net revenue goals for products and services designed for a lower-carbon economy. In describing their targets, organizations should consider including the following:

‒ Whether the target is absolute, or intensity based.

‒ Time frames over which the target applies.

‒ Base year from which progress is measured.

‒ Key performance indicators used to assess progress against targets.

• Where not apparent, the methodologies used to calculate targets and measures.

Conclusion

By using CarbonView, organisations will be well on their way to satisfying TCFD criteria. In particular, CarbonView is a handy tool for organisations to meet the criteria included in the Metrics and targets element as far as quantifying carbon emissions along the value chain and setting targets in line with mandatory or voluntary targets.

Further, the CarbonView process will greatly assist with the development of the three other TCFD elements i.e. governance, strategy and risk management.

Visit the CarbonView website to find out more!